charity (10)

Came across this check list from a recent newsletter that I subscribe to at Carters Law

https://www.carters.ca/pub/checklst/Charity-Checklist.pdf

It's packed with a great list, if your involved with a charity or non profit, it would be a wise investment of your time to check it out and share with your board.

For non profits

Legal Risk Managmeent Checklist for Ontario-Baed Not-for-Profits - Nov 2023 (carters.ca)

The year 2022 is coming to a close , and with it the opportunity to bless a charity, support a political cause financially. There is more to giving than money, financial gifts will get you a tax credit that you can use on your taxes , however they have to be made by midnight Dec 31, 2022. I am going to list a few of my favorites, and I welcome you to become a member and share yours in the comment section below. I will also be adding links as resources in the comment section of this postig, so as always check those out.

If you search this platform for Donations & Giving , here is a list of the highlights from the past

https://improvingfutures.ning.com/main/search/search?q=donations

https://improvingfutures.ning.com/main/search/search?q=giving

Some Local, National & International Charities & Foundations

https://www.rotary.org/en/about-rotary/rotary-foundation

https://www.brockvilleandareafoodbank.ca/donate/#Cash

https://www.canadahelps.org/en/charities/the-salvation-army-brockville-community-church/

https://www.yourcommunityfoundation.ca/

https://4-hontario.ca/about-4-h/the-ontario-4-h-foundation/

https://www.eastersealscamps.org/about/camp-merrywood

https://www.eastersealscamps.org/about/wish-list

You may make a year end donation to your home church to support their ministry. You may want to do some extra, so should consider that many of our local church's have beneovant funds, you could donate to one of them with a comment for beneovalant fund, and they will seek out needs in the community with those funds. Search online or attand a service at Christmas or New Years Eve. Note donations New Years Day will not apply for deduction in 2022, but 2023

Political Donations

https://www.newblueontario.com/donate

https://www.peoplespartyofcanada.ca/donate-cc

Other Options

It is getting late in the year for donation of stock, shares, etc. There is some significant tax benefots to do so. These should be planned out with our tax team. You an also setup your own donor advised fund. There are typically donations that one would be considering in the 10,000 plus range. Please contact our office advisor@timothyross.com to discuss how this can be arranged.

https://www.mackenzieinvestments.com/en/services/mackenzie-charitable-giving-program

In the meantime, here is great article to read up on it.

There is so many other worthy causes. Find one that means something to you and bless them this holiday season.

The Lord loves a cheerful giver.

Be Blessed this holiday season.

TLR

“I have found that among its other benefits, giving liberates the soul of the giver. ...

“Always give without remembering and always receive without forgetting. ...

“Giving does not only precede receiving; it is the reason for it. ...

“It's easier to take than to give. ...

“No one has ever become poor from giving.

“Don't Just"

Don't just learn, experience.

Don't just read, absorb.

Don't just change, transform.

Don't just relate, advocate.

Don't just promise, prove.

Don't just criticize, encourage.

Don't just think, ponder.

Don't just take, give.

Don't just see, feel.

Don’t just dream, do.

Don't just hear, listen.

Don't just talk, act.

Don't just tell, show.

Don't just exist, live.”

― Roy T. Bennett, The Light in the Heart

This is an interesting discovery, check it out. If your interested in public service or know someone that is.

Also, it's good time to pick up a donation credit if this is worthy of your support and you would like a tax deduction on your taxes.

" Liberty Coalition Canada formed the "Christians That Care" (CTC) initiative to help Christians get elected and ultimately influence laws to align with biblical principles.

In 2022, we had 110 Christian candidates from 4 different provinces sign up to get training from CTC for their 2022 municipal elections and 16 of them got elected! CTC candidates received a total of 146,173 votes! We also had 20 CTC candidates come in second place, and 9 CTC candidates came within 250 votes of winning!

In 2023, we plan to expand the "Christians That Care" (CTC) initiative and begin operations in 5 different provinces by hiring dedicated Project Managers, with goals to:

1) recruit 500 new Christian politicians across the country;

2) recruit 500 new Christian campaign managers;

3) recruit 250 youth to our “Youth With A Vision” Political Development Program

4) teach churches how to organize around a local Christian candidate;

5) develop a division that supports currently elected Christian politicians.

In order to reach these goals, WE NEED YOUR HELP! To contribute to LCC’s Advocacy Department, click HERE, select the "Donate to Other Designations" box, select the "Where can we designate your donations" drop-down menu, select "Advocacy," and fill in the rest.

For more specific information about any of these Advocacy items, to get involved individually or as a church, to discuss becoming a candidate, to sign up a youth to our development program or to get more specifics, contact mclark@libertycoalitioncanada.com

Donate | Liberty Coalition Canada

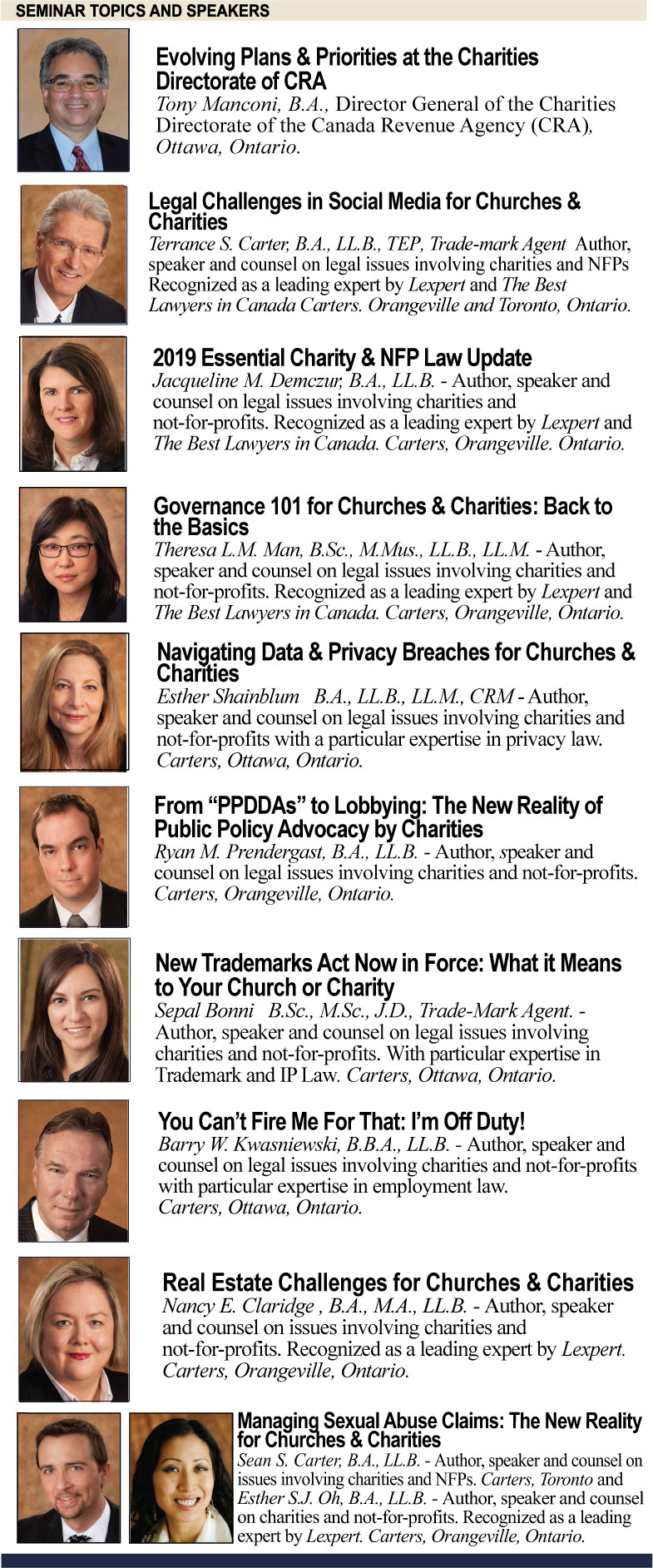

Looking forward to attending Charity Law Update this week

Hope your holidays have been going well, and my prayer is that 2021 is full of joy and peace for you, your family and the organizations that you care for.

As Bob Dylan once said, “May God Bless you all with peace, tranquility and good will.”

Cheers

Tim

https://improvingfutures.ning.com/blog/merry-christmas-2020

https://improvingfutures.ning.com/blog/holiday-schedule-year-end-2020

https://improvingfutures.ning.com/blog/your-tv-interview-with-tim-2020-year-end-tax-review

https://improvingfutures.ning.com/blog/meet-tim

November 18, 2020 – My Legacy: Envision, Build, Communicate and Live Your Best Legacy

A. Director, Legacy at Toronto Foundation https://torontofoundation.ca/

B. Everyday Legacy: Lessons For Living With Purpose, Right Now.

https://www.everydaylegacy.com/livingyoureverydaylegacy:findingpurposeevenintimesofuncertainty

Your Tool For Clear And Intentional Generosity https://thesignatry.com/

DON’T LET FAMILY STORIES BE LOST AND FORGOTTEN https://paragonroad.com/

This is a great download https://paragonroad.com/5stories/

PEAK Disclosure - Click to gRow

Loving seeds, this is a great idea for organizations to consider to raise funds and encourage growing gardens

| Register Now! |

http://www.carters.ca/pub/bulletin/charity/2018/chylb434.pdf

|

Charity & NFP Law Bulletin - No. 434

Terrance S. Carter B.A., LL.B., TEP, Trade-mark Agent and Ryan M. Prendergast B.A., LL.B.

On October 25, 2018, the Department of Finance Canada tabled in the House of Commons a Notice of Ways and Means Motion, which contained a number of amendments to the Income Tax Act ("ITA") and other legislation to implement certain provisions previously announced in Budget 2018 and other measures, including amendments to the ITA to modify the rules governing political activities (now referred to as "public policy dialogue and development activities") by charities in Canada. The proposed amendments were introduced as Bill C-86, Budget Implementation Act, 2018, No. 2, ("Bill C-86"), which received first reading on October 29, 2018, and is included as an appendix to this Charity & NFP Law Bulletin for ease of reference. Bill C-86 significantly improves upon the draft legislation released on September 14, 2018 by the Department of Finance Canada ("September Draft Legislation"), discussed in last month's Charity & NFP Law Bulletin No. 428

|